By 2014, it was déjà vu: 100G was replacing 10G at a similar clip, but this widespread capacity enhancement delivered an incremental ten-times increase for each traffic-carrying wavelength spanning the growing optical infrastructure.

Infonetics reported in their 2014 survey of service providers, “data centers and internet content providers (ICPs) will be the major customers for 100G [during 2015].” The report added that momentum for 100G deployment across metropolitan networks was driven by the need to feed 100GbE switches and routers found in data centers.

Infinera’s strategic move into an adjacent market is reminiscent of Ciena’s attempt to expand into the metropolitan transport market from its strong long distance market position over a decade ago. That company eventually acquired the bankrupt assets of Northern Telecom – and its Metro Optical team – in order to make headway into this more lucrative telecom space [2].

Mark Lutkowitz, an industry analyst who has been a steward of observing telecom trends suggests that the expected migration from 10G to 100G during 2015 may be delayed with the availability of 40G technology. It should be noted that 100G technology is more difficult to deploy than either the popular 10G rate or the oft-deployed, but less trendy, 40G.

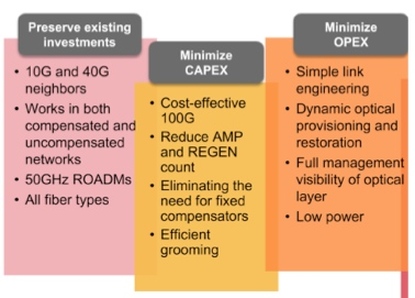

Lutkowitz highlights potential obstacles to widespread 100G deployment: “With 100G specifically in mesh networks, there is the potential problem of stranding a great deal of capacity [3] because it is often difficult to anticipate in advance the amount of bandwidth that will be needed in interconnecting dozens of nodes. In addition to the big challenge of economic matters, although 100G technology is extremely robust, and forward-error correction reduces a lot of operations challenges, it probably cannot be ruled out that a certain amount of line reconditioning and rehabilitation will be necessary in some of the older plant.”

As this occurs, 100G will continue to experience a rapid uptake during 2015.

[1] Please see my March 2015 interview with Infinera’s CEO, Tom Fallon here:

http://robkoslowsky.weebly.com/blog/-infineras-fallon-unlike-cisco-says-his-company-focuses-on-the-customer-experience

Since then, Infinera entered the metropolitan optical transport market with its acquisition of Transmode:

http://www.infinera.com/j7/servlet/NewsItem?newsItemID=450

[2] By then Nortel’s Greg Mumford had moved on and one of his product management lieutenants, Philippe Morin, took over the running of the metro optical portfolio within Ciena. Also see Mark Lutkowitz's take on Ciena's early history.

[3] One of Cerent’s innovations was support for a mesh architecture under the SONET/SDH umbrella of standards. The 1998 introduction of the Cerent 454, when deployed as a mesh of optical transport network elements, avoided stranding bandwidth in those links where rapid traffic growth was not foreseen.

RSS Feed

RSS Feed