Earl Turner, tw telecom’s Chief Architect, who I interviewed for my book project, worked with Tony Thakur on network architecture for the Time Warner “properties.”

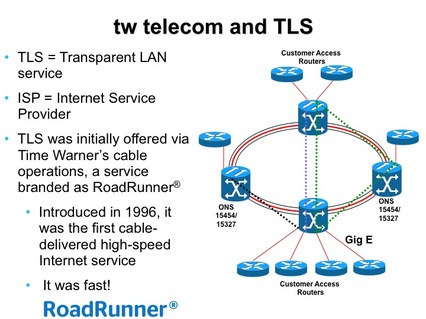

Todd Murphy, another Cerent sales rep, who worked the Time Warner Cable account in Denver, wrote, on October 22, 1999, “They intend to use the 454 as [an] OC-48 with DS3 drops and some OC-3/OC-12 drops. Tony has no current plans for TLS, but Earl said he may want to run their TWTC ISP traffic via the Ethernet card.” Murphy added, “Tony said the interoperability testing will be conducted with their Lucent and Alcatel cross-connects.”

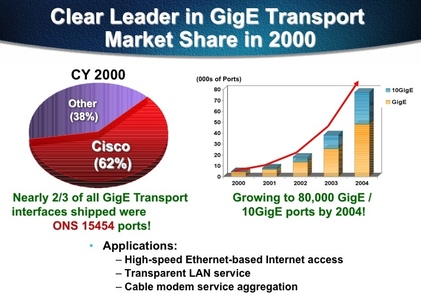

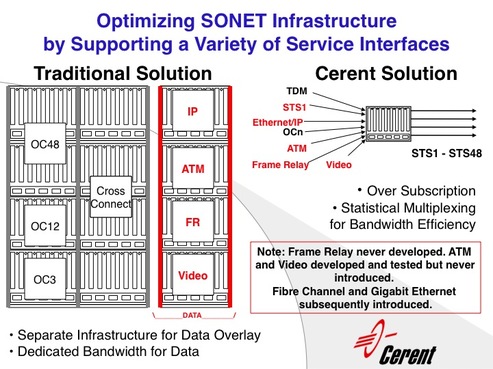

Dave Cesca recalls the time of the telecom meltdown in 2001, “When the market started crashing and the revenues went away, i.e., the voice revenues went away, service providers had to figure out how to deliver cheaper services. To the customer premise, T1 wasn’t cutting it, T3 wasn’t cutting it, and SONET wasn’t cutting it. More service providers were putting Ethernet capability into their buildings because customers were also asking for Ethernet to the building. The cost points for Ethernet came down to a point where it was more cost-effective to deliver Ethernet to the building and do so over a SONET box like the Cerent 454.”

Dave believes tw telecom was the first ‘327’ customer. However, as he recalls, “The ‘454’ still outsold the ‘327,’ but it was a super-critical component in the smaller offices.”

Earl Turner told me during our interview in 2013 that tw telecom bought about one ‘327’ for every ten ‘454s’ across the tw telecom network. More and more landlords were accepting MSPP-based gear located within their buildings.

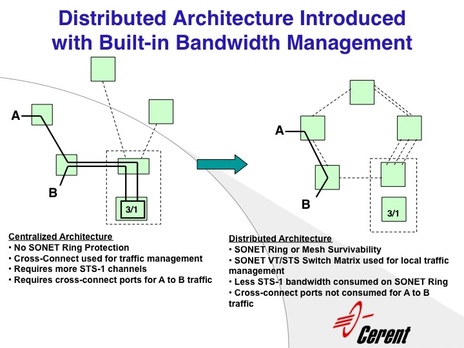

Tony Thakur said on July 19, 2000, at the ICM Conference in Washington, D.C., “Vendors: Please provide old and new services on one platform; multiple boxes to manage is not what CLECs want.” He continued, “You will see metro-DWDM for carriers and next generation SONET for others requiring service aggregation. Overlay networks will be built. [The operators] must be able to point and click so any wavelength can be set-up from A–to–Z.” He highlighted the importance of Next Generation SONET equipment, like the Cerent 454, for data applications.

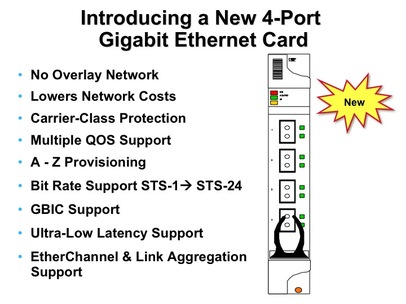

Stephen Zielke recognized the importance of Ethernet functionality on the Cerent 454 and Cerent 327 platforms too. During our October 2015 interview he noted how the optical team dodged the bullet on some of the failures of the Cerent team’s early Ethernet program (the so-called E-series cards). The Ethernet program became very important to grow the optical business as TDM interfaces waned. He said, “We failed with the E-series and we failed with the ML-series. We got it right with the line-rate G-series cards. Those cards were winners."

Steve’s assertion is seen by many Cerent pioneers as unfair, especially since the E-series program was key to penetrating the CLEC and ISP markets, the very market Steve was hired to tackle, which he did very well.

The history of Cerent’s E-Series Ethernet/Fast Ethernet plug-in is a story in itself. In short, the E-series solution was optimized for voice engineers to embrace data traffic in a TDM-based, service provider network. The E-series, Bob Bortolotto writes, “was designed, on purpose, to have nothing to do with IP, which is a layer-3 protocol. The purpose of the E-series was to statistically multiplex Ethernet traffic as transparently as possible (layer 2) over SONET TDM transport. This is exactly what our CLEC customers wanted at that time. They certainly didn't want an IP router inside their SONET ADM. The G-Series plug-in was the same basic card but with gigabit Ethernet interfaces and some other additional capabilities (like link aggregation).” As far as the ML-series Ethernet cards were concerned, Bob adds, “When you are part of Cisco, everything migrates to IOS, so that was the directive, good or bad.”

He said, “It’s been plugging away as far as I know. We were just working with this thing yesterday; we removed a DS3 in favor of an Ethernet interface. And I love the software. It’s user friendly.”

Fifteen years in operation and it’s still upgradable from TDM to Ethernet – not too shabby.

2003 Era for tw telecom

By March 19, 2003, the following customers were using tw telecom’s Metro Ethernet services over a Cerent 454 infrastructure. A tw telecom press release boasted, “Customers already experiencing the value of Time Warner Telecom Native LAN services include: First Tennessee National (Memphis), Bank of the West (San Francisco), Epic Imaging (Portland, Oregon), Carondelet Health Network (Tucson, Arizona), New York Unified Court System (Albany, N.Y.), University of Rochester (Rochester, N.Y.), Chase Manhattan Mortgage (Columbus, Ohio), . . .” and many more.

A couple of industry analysts praised tw telecom’s capital investments, in spite of the telecom meltdown just a couple of years before: “A lot of carriers are delaying capital expenditures in the hopes of boosting short term financial positions, and that's a huge mistake, because it gives competitors with foresight the opportunity to take your customers away with broader and more cost-effective services,” says Daniel D. Briere, CEO of TeleChoice, a telecommunications industry analyst. “Time Warner Telecom is not only willing to make that CAPEX spend, but they've already done it, and have launched and populated several leading edge metro Ethernet services. This raises the ante in the metro loop in all the markets where they offer service.”

Rouleau cited a May 2003 IDC report that tw telecom offered the most comprehensive Metro Ethernet Access speeds in the greatest number of markets (44 of them across 22 states) and with the greatest variety of applications (Transparent LAN Services or TLS, Fibre Channel, Internet Access, and ESCON for storage).

“Time Warner Telecom offers one of the most comprehensive metro Ethernet portfolios on the market today, encompassing point-to-point, switched multipoint and premium SONET-based Ethernet flavors, as well as Internet access over Ethernet,” said Ron Kaplan, Research Manager, IDC. "But offering services is not enough. Success in metro Ethernet hinges on fiber availability, and Time Warner Telecom has its own extensive metro fiber networks already in place. Combined, these two elements make Time Warner Telecom well-positioned in the metro Ethernet services market.”

“Our Native LAN services deliver Ethernet, Everywhere, Easily. That's tomorrow's network, available today!” Rouleau added. And both the Cerent 454 and the Cerent 327 had plenty of horsepower under the hood to ensure tw telecom met with success in the metro marketplace.

2013 Era for tw telecom

Fast forward a decade later: By November 7, 2013, tw telecom continued to grow. The service provider's on-net footprint sported a total of 19,648 buildings connected to its fiber network, up from 3,700 buildings ten years earlier.

“By accelerating the expansion of our existing markets using our established operational teams and infrastructure, as well as entering new cities where our customers already have networking needs, this expansion gives us quick access to current demand and an accelerated path to greater revenue opportunities,” said John Blount, tw telecom's chief operating officer, in a press release.

The timing of this expansion came as tw telecom reported that it earned $393.2 million of revenue in Q3 2013, up 1 percent sequentially and 6.6 percent year over year.

Less than two years later, tw telecom was acquired by its competitor, Level 3, primarily for its Ethernet services offerings and large installed customer base across the United States. Success begets success and Cerent’s evolutionary optical transport platform played a key part of tw telecom and many other service providers’ success introducing Ethernet-based service offerings.

RSS Feed

RSS Feed